By your side.

Zippy-di Quick

We Partner With

Check out our success stories:

Servicing Industries With Multiple Lines Of Insurance Needs.

Artisan Contractors

Interior Designers

Architects

Engineers

What Makes Us Different

Get a quote online 24/7 faster

Contact an independent agent when you need them

Receive coverage quickly and seamlessly

Access your insurance documentation in a flash

General Liability

Professional Liability

Cyber Liability

Commercial Auto Insurance

Event Insurance

Worker’s Comp

Surety Bond

A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

Find Your Bond:

Contract Bonds: Required by the State for Project Based work, including Bid or Proposal Bonds, Construction Bonds, Performance Bonds, and Supply Bonds.

License & Permit Bonds: Some businesses are required by law to purchase a surety bond before being able to operate, including health spas, liquor distributors, motor vehicle dealers, and tax professionals.

Miscellaneous Bonds: These bonds fall outside the other categories listed and include Lease Bonds, Utility Bonds, Lost Securities Bonds, and Self-insurers.

Federal Government Bonds: Some agencies of the Federal Government accept or require surety bonds in a variety of circumstances, including Immigration Bonds, Customs Bonds, and Alcoholic Beverage Bonds.

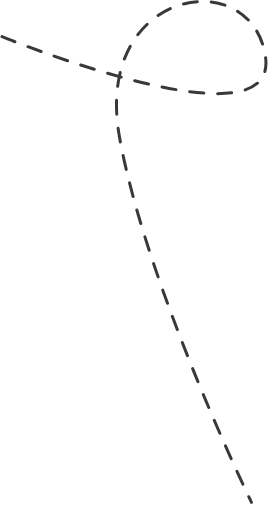

How Claims Work.

Get In

touch

Meet with

the

Adjuster

Start your

Legal Plan

Submit

your

Claim

Track

your

Claim

Don’t Just Take Our Word For It!

The Companies we have worked with in past are the witness of our success